NAPCO Security Technologies Inc. - ($NSSC) - Too Cheap to Overlook

The overall market sell off in 2025 thus far has brought many new investment opportunities. My portfolio has well outperformed the SPY so far, and with the most recent news from DM 0.00%↑ and MKFG 0.00%↑ mergers closing very soon, I will have some cash freed up to add to current positions and/or new positions.

One of the new positions that I’m eyeballing as a potential holding is NSSC 0.00%↑ (NAPCO). NAPCO is now down 62% from it’s high less than a year ago, however I’d argue this company is getting stronger each Quarter, which I will lay out in the thesis below and it is trading at an extremely cheap valuation for it’s quality.

Qualitative Analysis

How does NAPCO make money? - “NAPCO is one of the leading manufacturers and designers of high-tech electronic security equipment, wireless communication devices for intrusion and fire alarm systems and the related recurring service revenues.” In simplified terms, they create and sell security systems, and after the systems are installed by a 3rd party vendor, they then sell the software subscription to manage/monitor the systems.

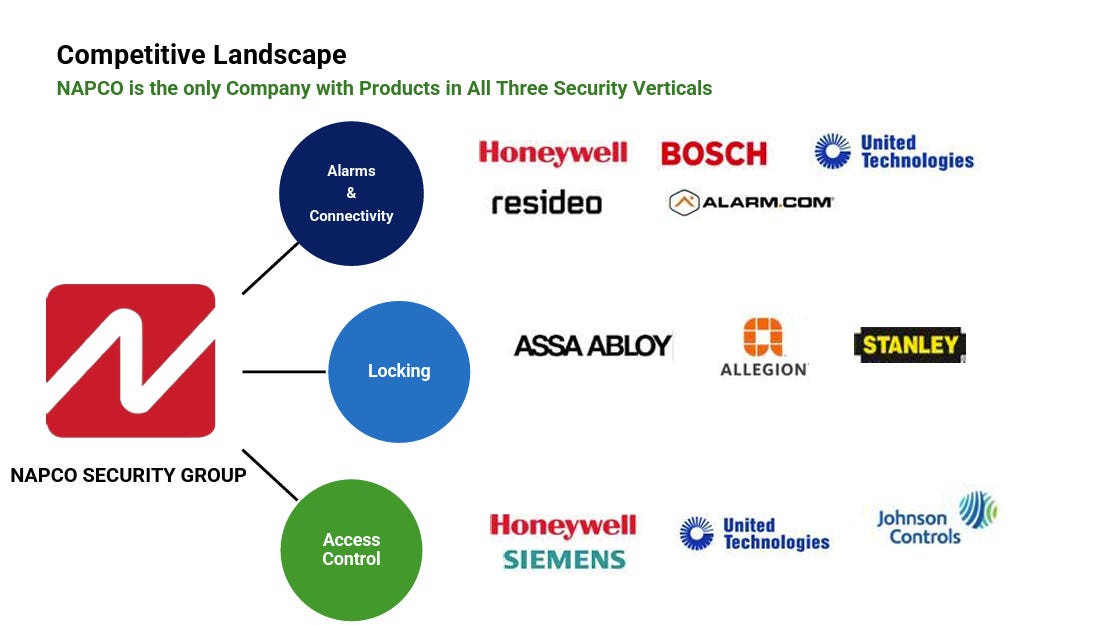

What is their Moat? - Their moat is “High Switching Costs”. Their services are VERY similar to payroll software companies. Once the security system is implemented and you sign up for their software subscription, it becomes very expensive to switch to another provider. For example, if you’re a school (schools are some of their main customers) and you install security systems across all of your campuses, and train maintenance/IT, your employees, etc. to use the software. The cost to rip out those systems, install new ones, and then train everyone to use a new system is very difficult and expensive to do, and the new product would have to be 10X better or wayyy cheaper in order to ever make that switch. This means once NAPCOs systems are installed, they become extremely sticky with a large moat. The front end sales process is what is much more competitive and where the main competition stems from. (See below slide from their Q2 2025 Presentation on competitors)

High Margin Business and becoming less cyclical - NAPCO originally was just a manufacturer and designer of these systems only. This led to extreme cyclicality as the revenues went up and down with the sales of equipment only to end users and the constant need to find new customers. In years of good construction, then you may sell more new systems and years of low construction volume then you may have down years causing earnings to never be consistent.

However, NAPCO realized this and added in a recurring revenue stream by offering a software subscription in order to connect to all of the implemented systems. This was a brilliant move by management as it creates a consistent flow of revenue plus it’s extremely high margin which is the opposite of just selling the equipment. Management in their most recent Q filing said the Recurring Service Revenue (“RSR”) has a 91% gross margin and they grew RSR revenues at 14%. This growth plus high margin is very exciting to see. However, as mentioned above the selling of the actual equipment systems is cyclical and they had an overall decrease in Revenue in the most recent Quarter (hence reason for price drawdown).

Quantitative Analysis

Financial Statements Details

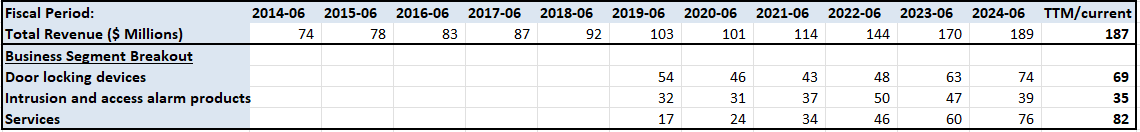

Revenues -

As seen above, the Revenues have grown steadily over the last 10 years with a recent TTM slow down, and I have provided the revenue by segment going back to 2019. What’s important to see here is that the Recurring Service Revenue over the last 6 years has gone from the smallest segment to now the largest. Based on current trajectory it will become over 50% of the revenues in due time and as mentioned this has the highest margins and most consistent income stream. Due to this, I believe we will start to see more consistency from their revenue as well as margin expansion each and every year. As long as they are selling new door locking devices and new alarm products, that means they will bring online more recurring service revenues plus hopefully maintain the systems previously sold. This will create the fly wheel of more services revenues and more revenues at a higher margin that will fall to the bottom line.

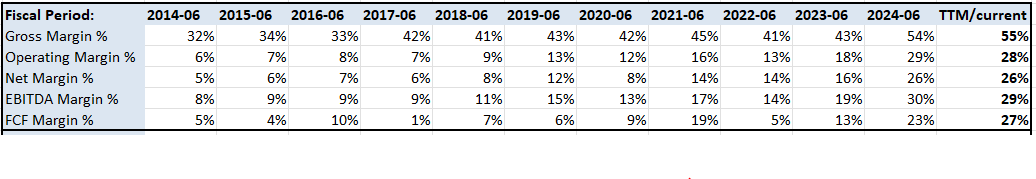

Margins -

As mentioned above, the margins have been expanding due to the recurring service revenue which has a 91% gross margin versus their lower margin equipment business. This shift of revenue allocation is allowing NSSC to increase all of their margins that follow Gross margins like Operating/Net/FCF margins. Having net margins over 25% is extremely strong and not many businesses can operate this successfully unless you have a strong moat.

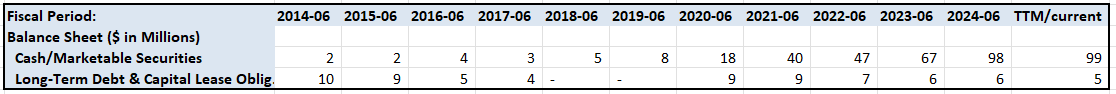

Balance Sheet Items -

Cash / Debt -

As seen above, NSSC has a $94M net cash position. Their market cap is $838M, so 11% of their market cap is net cash. If we back that out of their price the company operations is really trading for more like $20 a share. This strong cash positions is a great spot to be in as it allows flexibility in downturns. Additionally, they have the ability to acquire competitors if needed to add to their vertical stack.

Valuation -

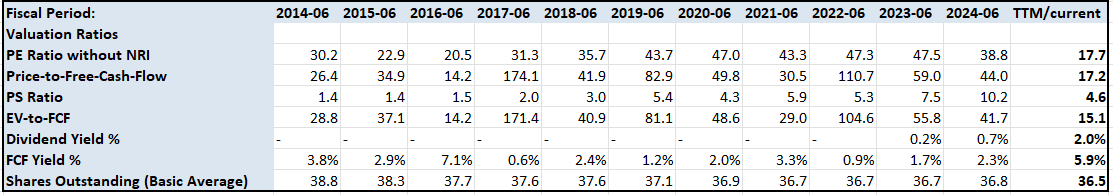

I narrowed this down to what I deem the most important metrics.

PE Ratio w/o Non Recurring Items - Historical low at 17 PE. I believe this is a very fair valuation and part of the pull back in stock price comes from the slow down in revenues. As mentioned, we are starting to see the shift to recurring revenues, and overtime those will continue to make up a larger share and increase their earnings. Hopefully, this means the price will start to follow.

P/FCF and EV to FCF - Similar Trend as PE, being at 17 and a historical low. They are doing a great job at converting earnings into cash. Also included Enterprise value to show how much of an impact net cash has. When including net cash you can basically take off another 10% on every Price to “X” valuation metric.

PS Ratio - This typically is not a super meaningful ratio when looking at businesses that have a history of making money. However, watching the transition to a SAAS business, it’s important to know SAAS companies typically carry a much higher PS ratio than a standard business. It’s not uncommon to get a 10X PS multiple. They currently trade at 4.6, but also note that half their revenue is not SAAS, so maybe they should get a 7 PS multiple to be fair.

Dividend Yield - They recently started paying a dividend. With the recent drawdown the yield has gone up significantly, and you can now earn 2% yield at today’s prices.

Shares Outstanding - As you can see share count has barely decreased over the last 10 years. I would like to see this change and for them to use their excess cash and their FCF to start buying back shares at these prices. I believe this would be much more meaningful than giving a dividend.

Based on these details of transitioning to a better business as they move into a recurring revenue business model with their software systems plus trading at a historical low valuation with a strong net cash position. I believe NSSC has very limited downside risk at these prices, but very high upside over the coming years. If they can get to a 50%+ recurring revenue business that is growing in the mid to low teens, we can see earnings grow at an exponential rate due to the high margin nature, and see a rerating in the multiple they are currently trading at.

As always, please let me know your thoughts and opinions on this investment idea.

-Value Chaser